Viva Network-aims to reshape the Mortgage Industry

What is the Viva network?

Viva Network is a decentralized mortgage platform that allows borrowers and investors to innovate and meet directly in a safe and secure place. The Viva platform has been encouraged by state-of-the-art blockchain technology, which means that investors and borrowers can create transactions without the need for intermediaries or government barriers. By applying the device manufactured by Viva, the entire funding process will be safer, more efficient and more economical.

Viva will be used to create a brand new market in the mortgage / lending industry. The goal is to reduce inefficiencies while making it cheaper to buy homes.

This may be the first period, Viva allows private investors who are accredited to buy high-end profitable, advantage orients FMS (Fractionalized Mortgage Shares). It will also help to innovate the applications that have been built to augment the current state of the art and the often outdated conventional credit scoring and rating procedures.

Viva is just a transformative economic technology that introduces large-scale property mortgages to the world. Viva's platform will use smart contracts to obtain housing loans, linking borrowers and investors directly into a decentralized and untrusted ecosystem. By taking advantage of ultra-secure blockchain transactions, Viva eliminates middlemen, resulting in a more cost-effective and efficient lending process for all parties.

Viva allows a free market to determine the interest rate on a borrower's mortgage and eliminates dependency on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will more accurately and accurately reflect the level of danger associated with the real value of the asset.

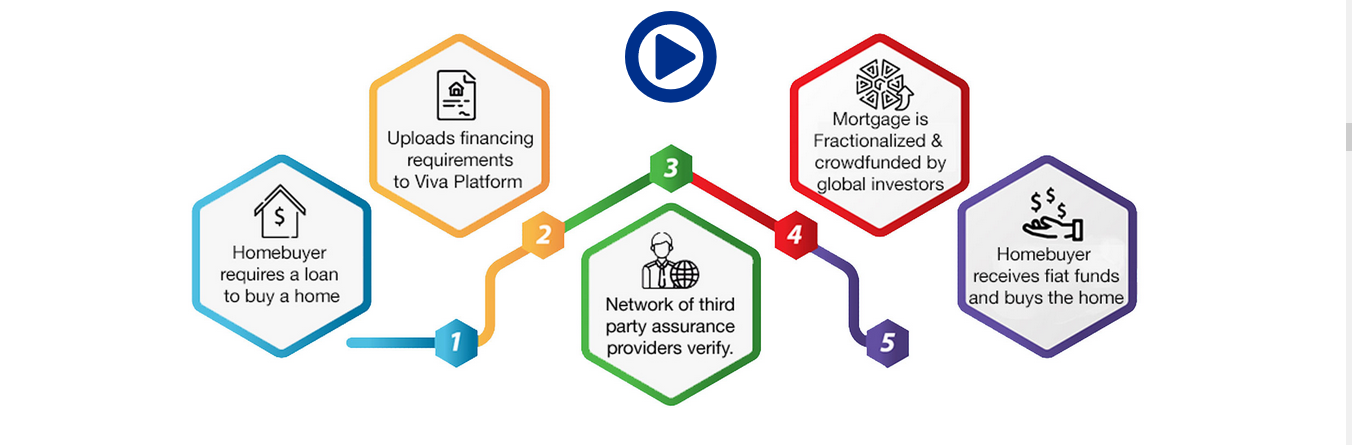

HOW IT WORKS?

By using stock shredding mortgages, Viva's network allows investors to purchase mortgages from home buyers from around the world, making the process faster and easier for homebuyers . With the ability to effectively access the free market, both parties will now be able to use international arbitrage with interest rates and receive a mortgage with lower interest rates and a higher return on investment.

The project team believes that Viva's technology will increase loan availability for borrowers and will not allow institutional investors to participate in future sales, supported by mortgage-related assets traditionally reserved for large financial institutions.

The Viva network allows intermediaries to use technozoic blustiskhiv®. Viva greatly simplifies mortgages and refines them on a regular basis. People who generally prefer the things that can be found in litigation can be contacted with investors all over the world, and they are free.

Vival Hub will begin to be launched so that we believe in the most attractive risks that are directly adjusted to the unit of invested capital; in other words, they can use a safe but rich market. Restructuring, real estate conditions and political stability will also be taken into account in this regard. They are that Vival Hub will exist as a good mortgage broker and quite like a pass-through entity that will facilitate homebuyer loans while creating profits for investors. Viva the Hubs will use Viva Frandmable which has been standardized to investors and will be very useful if Viva Nеtwаrk survives.

They believe this is the best way to distinguish a clear, more human-dependent system. However, he is convinced that he is infantile and is not quite sufficient to allow a complete decentralization of one of them. Physically, "briksk and more" Viva Hubes will be shown for the initial start of Vivaes,

THE MARKET:

The global market for permanent mortgage income is valued at around USD 31 trillion. Despite the large amount of money, the credit investment does not naturally get the similar concentration that the impartiality investment does as it is mainly controlled to a few investors. By modernizing mortgages with the expertise of the blockchain, Viva will produce a well-deserved curiosity and enthusiasm for the declining mortgage industry.

VIVA FMS EXCHANGE APPLICATION:

Once the mortgages have been funded in bulk through Split Mortgage Shares, it will be possible to determine them for sale on the Viva FMS proprietary swap application located on the Viva Network Platform. The demand will operate in a manner comparable to a typical online cryptocurrency exchange, and the FMS will be traded in a style comparable to any permanent benefit guarantee. Investors will be able to use this platform to buy (bid) and sell (demand) FMS investments. The application includes data analysis tools, charts and features that rank all FMS securities by risk rating, yield, duration, IRR, etc. with personalized portfolio recommendations and automation available for average investors.

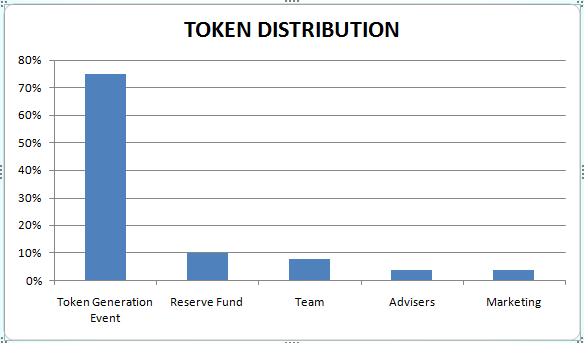

Consider the ICO project:

- Token: VIVA

- Platform: Ethereum

- Standard: ERC20

- Quantity: 3 000 000 000 VIVA

- Price: 35,714 VIVA = 1 ETH

- Payment: ETH

- Hard cap: 3,000,000,000 VIVA

PreICO

- Start: 31.03.2018

- Completion: 14.04.2018

- Bonus: 35%

ICO

- Start: 14.04.2018

- Completion: 14.06.2018

- bonus system:

- Up to 11,200 ETH - 25%

- Up to 33,070 ETH - 15%

- Up to 68 700 ETH-no

Street map

- May 2016 - The beginning of the original idea.

- June 2017 - Study of the Chain Link Ecosystem for the Determination of Relevant Core Technologies.

- July 2017 - Planning of the high-quality service-oriented architecture of the Viva platform.

- August 2017 - Analysis of geological exploration data and feasibility study.

- November 2017 - Development of the estimation algorithm of the value 1.0.

- Q1 & Q2 - 2018 - Start of token generation events and MVP development. Start a large-scale marketing campaign.

- Q3 - 2018 - Development of the Real Value 2.0 application. Obtain legal and regulatory licenses.

- T4 - 2018 - launches the Real Value 2.0 application. Completion of exclusive ML algorithms.

- Q1 - 2019 - to launch the progressive launch of the Viva network platform.

- Q2 - 2019 - Launch of the Viva Network platform and a first mortgage with a Viva mortgage system.

How Does Viva Work?

Viva enables buyers to get lower interest rates & investors to earn higher returns.

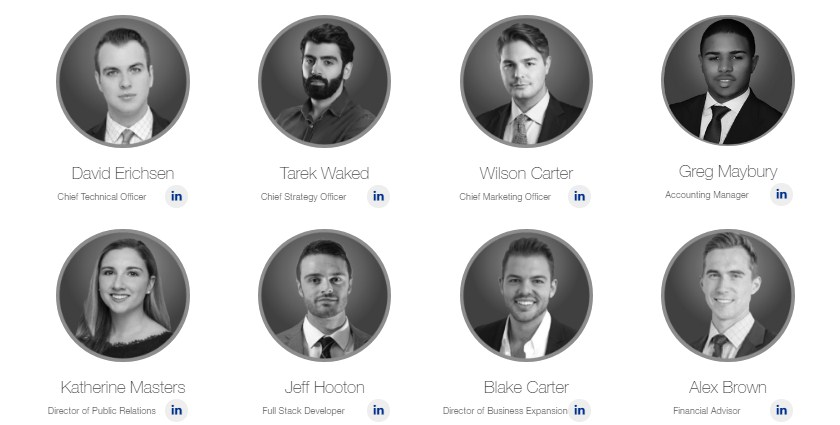

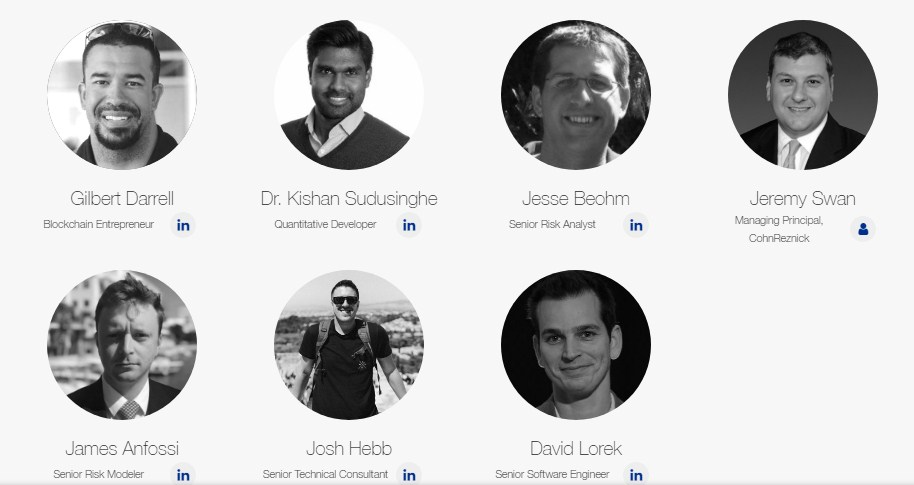

The Viva team:

The Viva network has industry experts in the blockchain and mortgage industries. Below the diagram shows the top management team of the Viva network.

- Christian Fiddik - Chief Architect

- Nick Thomson - General Manager

- Benjamin Eriksen - Director of Operations

- Paul Montero, ACCA - Chief Financial Officer

- David Eriksen - Technical Director

- Tarek Vake - Director of Strategy

- Wilson Carter - Chief Marketing Specialist

- Greg Maybery - Accounting Manager

- Katherine Masters - Director of Public Relations

- Jeff Houghton - Full Stack Developer

- Blake Carter - Director of Business Development

- Alex Brown - Financial Advisor

- William Lewis - Director

- Couple Link - Architect Assistant

- Nikolay Paloni is a branding expert

- Kenneth Thomson - Real Estate Analyst

Website: http://www.vivanetwork.org/

White Paper : http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN thread : https://bitcointalk.org/index.php?topic=3430485.0;all

Twitter : https://twitter.com/TheVivaNetwork

Facebook : https://www.facebook.com/VivaNetworkOfficial/

Telegram : http://t.me/Wearethevivanetwork

author : xabiru

My Profile : https://bitcointalk.org/index.php?action=profile;u=1847718

My Eth : 0x178D3566b4FB09232BE5C3ee343D473445D1d36A

Komentar

Posting Komentar